NEC Newsflash: This Week Sept. 25′ in Munich

21. September 2025

Above the Clouds the Sun always Shines!🌤️🌦️⛅️☀️

9. November 2025Development of the HK/CN bull market

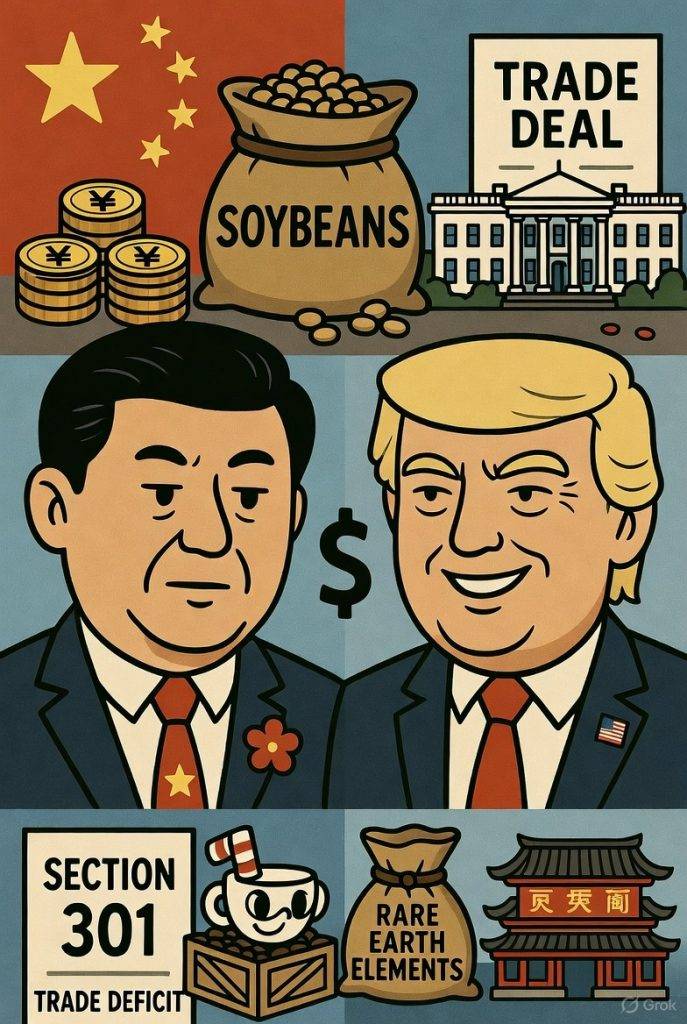

This felt like a good starting point for the blog, as it is arguably one of the most important weeks for the Chinese economy. The conclusion of the fourth plenum1 on the 23rd of October, and arguably more importantly, President Xi and President Trump are scheduled to meet on the 30th of October, in Busan, South Korea, the first meeting between the leaders of the two biggest economies on this planet since Mr Trump’s return to the White House. No doubt, trade will be an important topic. Although it is expected that the two sides strike some sort of deal – China will resume buying American soybeans, and more importantly, delay its export ban on rare earths. In exchange America will, at least for now, not impose 100% tariffs on Chinese exports to America.

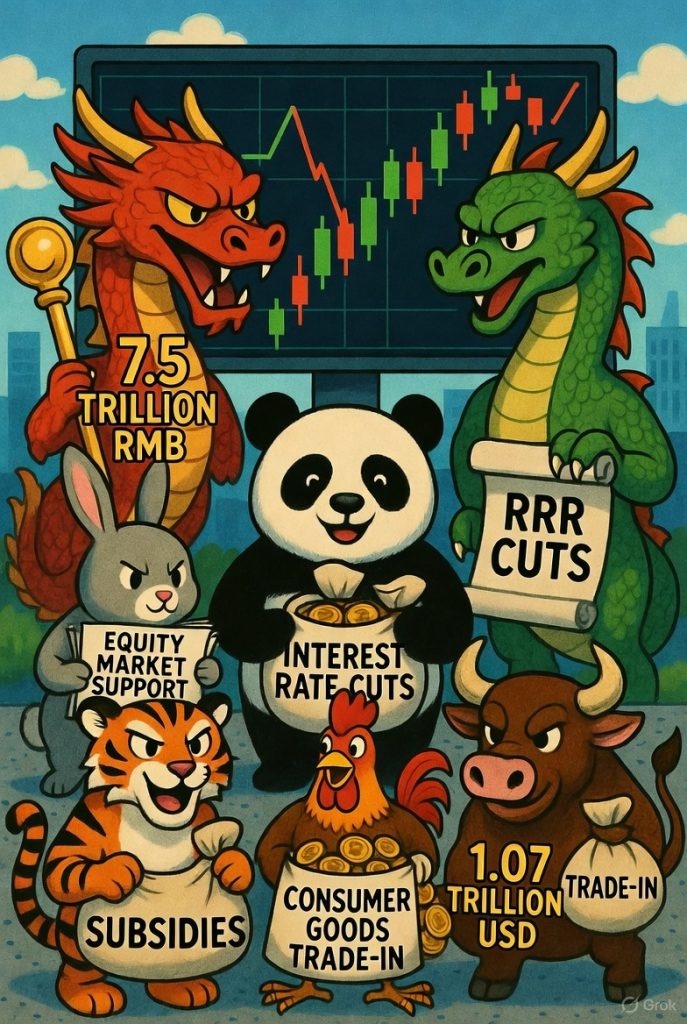

Just over a year ago, September 2024, talks of a massive stimulus package from China, in an effort to reflate its economy. Interest rate cuts, RRR2 cuts, support for the equity markets through its “national team”, subsidies, consumer goods trade in program, with a total estimated monetary value of around 7.5 trillion RMB (≈ 1.07 trillion USD). This sparked a huge rally in the HK China equity markets, before temporarily, saw itself crashing back down, losing almost half of the value of the rally in 10 or so days.

Fast forward a year, the HK China equity markets have more or less stabilized into a steady bullish rise over the year, with the HSI, at the time of writing, being THE outperforming major index this year, north of a 30% increase YTD. Where do we go from here?

First, we have to understand that the valuations of Chinese companies are still somewhat affected by the underwhelming Chinese economy since 2018. The structural slowdown in GDP growth and an ongoing property crisis hugely contributed to the underperformance of the equity market. Take for example the Hang Seng Tech Index, as of October, its P/B3 ratio is around 3.20 and its P/E4 ratio, around 21.29. Compared to the US tech sector, with P/B ratio trading at 14.71 and P/E ratio at 46.62. Discounting the potential that US tech stocks may be overvalued, this is still a very big difference in valuations, more than 4 times P/B and 2 times P/E. It seems like the undervaluation is still there.

Second, the trigger for the bull market, the stimulus, the policies. The IMF has estimated China’s GDP growth in 2025 is around 4.8%, shy of the 5% target. Although stimulus schemes have helped with boosting consumption growth, there is concern of the lack of long term impact, especially with inflation numbers still hovering around 0. The most recent? 500 billion yuan deployed in policy based financial tools suggested to enhance financial services and accelerate investment projects. There were also a lot of mentions of a social welfare reform to boost consumption, but this was a lot of talking and much less doing. Is the momentum of the stimulus running out? During the fourth plenum, China’s 15th five year plan was approved. Within the core objectives include – Technological self reliance and innovation, boosting domestic consumption, high quality economic development, social welfare and equity and environmental sustainability. The first two core objectives suggest that stimulus and policies to continue, even intensify in the coming years. The full plan will only be released at a parliamentary meeting in March, still much is needed to reflate the economy. As for data to monitor the progress, manufacturing PMI5 is a good benchmark, providing data of all activity within the manufacturing sector every month with above 50 showing that it is expanding, latest data shows that China’s PMI for September sits at around 49.6 to 51.2 depending on the surveyor but with that was the strongest since March.

I must also mention that HK China equities trade a lot on earnings growth expectations. Also from what I have seen, there seems to be some sort of short term selling pressure after earnings release, even if results seem to beat expectations, although this is my observation and I could just be wrong. To me it seems like southbound flow6 contributes to this, even after a set of strong results, as they are very erratic, perhaps due to profit taking. As for my take on positioning, note that institutions have been accumulating long positions within the market for more than a year throughout the bullish trend. For me, the idea is still to target valuations for bottom fishing after the recent pull backs.

– Home appliances and electronics, my picks are Haier Smarthome 6690HK and TCL Electronics 1070HK. This seems like the obvious choice, especially with subsidies and stimulus aimed at home appliances alongside the trade in programs for old home appliances. Haier being one of the largest players in the market. Their first half 2025 revenue and operating profit grew by 10% and 11% respectively, perhaps proof that the subsidies and trade in program have contributed to the growth in the industry. Currently P/E is sitting at the bottom 6% percentile in the past 5 years. TCL Electronics, first half revenue and operating profit, 20% and 62% increase respectively. The high beta7 pick for me in this industry, they had profitability challenges before successfully repositioning and expanding their product portfolio. EPS and profit margins have improved and steadily increased over the years. Very similar to Haier, TCL electronics P/E ratio, currently 10.79.

– E-commerce, be extra cautious of the high volatility within this sector. This is the alpha8, at least for the last year or so. As our world shifts more and more online, e-commerce is unavoidably going to grow and no other country has a bigger online market space than China, but what to choose? Popmart 9992HK, known for selling toys, fictional models. Why popmart? Of course because of Labubu and its huge surge in population driven by mainstream media. But on a more serious note an extremely impressive 250% YoY increase in revenue growth in 3Q of 2025, mainly driven by the crazy demand from America and Europe. Popmart is expanding fast and in mass, a 370% overseas expansion. Current shops in America and Europe have seen around 1,270% and 740% in growth. In terms of valuation, P/E is sitting at the bottom 27% percentile historically, to me seems undervalued but 41.63 as a number looks high. Also, be aware of shifts in trends and consumer preferences, I am also still somewhat skeptical of how long this dramatic outperformance can last long term, therefore for now, I think a shorter term approach may be more apporpriate instead of targeting longer term growth.

This would not be an article written by me without Xiaomi 1810HK, possibly one of the most exciting tech companies out there. Other than being one of the biggest phone manufacturers in the world and manufacturing almost every possible electronic device and home appliance, it has also managed to successfully penetrated into the EV industry, being one of the fastest growing EV brands in the world, stock price trades a lot on top line earnings growth and news on the EV arm. Perhaps more excitingly, Xiaomi are also attempting to design and manufacture their very own chips. Recent underperformance has stock price trading around 45-50 HKD range. My current price target for the stock sits at 60 HKD, whilst it has reached 60 HKD twice this year it has proven to be much of a top end resistance level, therefore I would like to see it reclaim this mark and go from there.

Tian Xuan Zhou (Oliver)

Student, New European College – Munich

- China has in total seven plenums in each five year terms of the congress, where the party’s central committee come together and discuss key policy and leadership issues

- Reserve Requirement Ratio (RRR) – the percentage of customer deposits that commercial banks are required to hold in reserve and cannot lend out

- A comparison of a firm’s market capitalization to its book value

- A comparison of a firm’s market capitalization to its earnings

- Purchasing Managers Index (PMI)

- Southbound flow is the money from Mainland China into Hong Kong through the stock connect system allowing Mainland Chinese money to invest in stocks listed in Hong Kong. Northbound being the opposite

- Stocks with greater volatility

- Market outperformers